What is a Trading Strategy? Best 5 Trading Strategies.

- A trading strategy is a well ordered method devised to generate a profitable return on investment. It is widely harnessed for purchasing and selling securities.

- A trading strategy is worthwhile if it is objective, accordant, verifiable and quantifiable. A wise trading strategy includes a systematic plan in which investment and trading objectives are clearly expounded.

- In the market, a variety of trading strategies, based on fundamental or technical criterions are used. Both these parameters are based on quantifiable information that can be confirmed for accuracy.

- A trading strategy is crucial because if utilized wisely, it will help you make money. It can culminate in loss if used otherwise.

IMPORTANT LINK:

![]() શાળા પ્રવેશોત્સવ બાબત પરિપત્ર ડાઉનલોડ કરવા અહી ક્લિક કરો.

શાળા પ્રવેશોત્સવ બાબત પરિપત્ર ડાઉનલોડ કરવા અહી ક્લિક કરો.

Best 5 trading strategies

1. News trading strategy

- This is a comparatively easy and simple trading strategy that entails trading based on news. This is dependent upon market sentiments, both before and after the release of the news.

- Traders will need to evaluate the impacts of the news expeditiously after it is released. For good returns, they have to make a quick decision on how to use the news for financial gains.

- You will have to devise trading strategies for specific news releases.

- While taking decisions, you must always keep remember that market expectations and market reactions are more crucial than the news release.

- Successful implementation of this trading tool makes the awareness of how financial markets operate necessary.

- News trading furnishes multiple gains in trade, but it is indispensible to have expert skills and clearly demarcated entry and exit points to minimise the risk.

2. End-of-day trading strategy

- This trading strategy implies trading when the markets are about to be closed.

- A sincere study of prices compared to the previous day’s price movements is a requisite. End-of-day traders then deduce how the price will move based on the price action. Traders should create a well planned set of risk management orders to minimise the chances of overnight risks.

- This type of trading makes possible to commit lesser time than other trading strategies.

3. Swing trading strategy

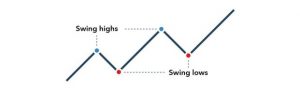

- In simple words, Swing trading alludes to move on both the sides of the market.

- When the Swing traders perceive that the market will jump up, they start buying the securities.

- When they sense that the market will plummet, they start selling the securities.

- This kind of trading is entirely a technical approach to analyse the market sentiments.

- Successful swing trading depends on the accurate elucidation of the length and duration of each oscillation.

- People who have restricted time available can opt for this type of trading since it provides numerous trade opportunities. But in return, swing traders will have to do a thorough research for sufficient financial gains.

4. Scalping trading strategy

- This kind of trading devises very short term trade with small price movements. So they earn a tiny amount of profit from the trade of securities.

- This requires a well planned, sound and firm exit strategy.

- Scalp traders look to amass a large sum of money with extracting profits from a large number of small trades.

- Scalping can provide multitude of trade benefits but it is has restricted applicability in financial markets such as indices, bonds and few types of equities.

5. Day trading strategy

- If you believe that trading is your full time calling, you may want to dive into this type of trading, known as intra-day trading as well.

- This requires diligent trade in the daytime.

Traders rely upon the undulations of prices in between the open and close hours of market. - Day trading is immune from overnight risks and can provide you with multiple trade opportunities. But this necessitates a very well organised trading plan that is adaptive to altering market movements.

- On occasions, flat trade materializes, which is not favorable for very short term investments.

Bottom line: We often wonder which market strategy is best and highly compliant. But the fact is that the performance of these strategies depends on multiple market factors. You can employ any trading strategy mentioned above according to your needs, and adaptability. But always assess the available capital and risk factors. With correct strategy, you can amass a handsome amount of financial return.